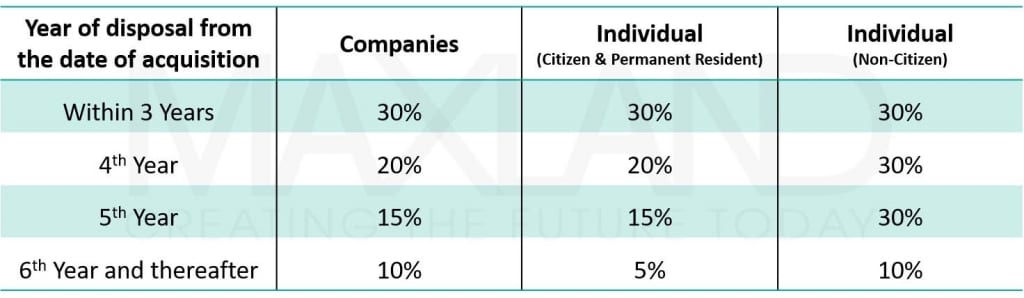

RPGT Rates Classification

RPGT Exemptions

Good news! There are some exemptions allowed for RPGT. Among the exemptions are:

- Exemption on gains from the disposal of one private residential property once-in-a-lifetime to an individual (please utilise this once in lifetime opportunity wisely).

- Exemption on gains arising from the disposal of real property between family members (e.g. husband and wife; parents and children; grandparents and grandchildren).

- 10% of profits OR RM10,000 per transaction (whichever is higher) is not taxable.

- Low cost, low-medium cost and affordable housing priced below RM200,000 will be exempted from RPGT.

RPGT Exemption Order 2020 (“Exemption Order”)

Announced during PENJANA 2020, under the Exemption Order, gains arising from the disposal of residential properties after 1 June 2020 until 31 December 2021 will be exempted from RPGT. Such exemption is granted for up to three residential properties per individual if the following conditions are fulfilled:

- the disposer must be an individual who is a Malaysian citizen and is the sole or joint owner of the property to be disposed;

- the property disposed must be a ‘residential property’, namely a house, a condominium unit, an apartment or flat in Malaysia, and includes a service apartment and a small office home office (SOHO) which is used only as a dwelling house;

- the residential property which is being disposed of is not acquired by way of: transfer between spouses; or a gift between spouses, parent and child, or grandparent and grandchild where the donor is a citizen; and

- the SPA for the disposal of the residential property is executed on or after 1 June 2020 but not later than 31 December 2021 and is duly stamped not later than 31 January 2022. Where there is no SPA, the instrument of transfer for the disposal of the residential property is executed on or after 1 June 2020 but not later than 31 December 2021, and is duly stamped not later than 31 January 2022.

Where an individual disposes of more than three units of residential properties, the disposer may elect any three from the said disposals to be exempted. Once the decision is made, the election is final and irrevocable.

In the event the disposal of the residential property is a conditional contract requiring the Federal Government or a State Authority’s approval, the exemption will be applicable subject to the following conditions:

- the contract of disposal of a residential property is executed on or after 1 June 2020 but not later than 31 December 2021 and is duly stamped not later than 31 January 2022; and

- the approval is obtained on or after 1 June 2020.

Similar to the stamp duty exemptions under HOC, it appears that the RPGT Exemption is only given to Malaysian citizens. Currently, the applicable RPGT rates for Malaysian citizens and permanent residents range from 5% to 30% depending on the holding period.

CLICK HERE to refer to the Exemption Order copy.

SOURCE FROM: https://loanstreet.com.my/

免费马来西亚房地产分析与趋势

每月获得有关马来西亚房地产市场的趋势及独家分析,讯息将会发送到您的收件箱,以让您获得早期投资的机会。